HEADER: IDENTITY DATA VERIFICATION

IDENTITY DATA VERIFICATION

IDV prevents digital fraud and supports the Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. IDV is the process of ensuring that a person is who they say they are when opening a bank account, applying for a loan, and many other identity validation processes.

SUB TÍTULO HEADER

The importance of this procedure grew because of the data breaches, account takeover attacks, and identity theft on the rise and an increased demand for remote processes due to the pandemic. Businesses need to detect identity fraud and determine if someone is who they claim to be in the digital era.

6623b03a31ba8

Playing a vital rol in AML and KYC efforts to monitor customer risks

AML

Anti-money laundering (AML) refers to laws and regulations intended to stop criminals from disguising illegally obtaining funds as legitimate income. Although you, as a company, stick to the rules; this does not mean that your partners and business associates adhere to the same AML compliance laws as you.

KYC

KYC check is the mandatory process of identifying and verifying the client's identity when opening an account and also periodically over time. In other words, banks must make sure that their clients are genuinely who they claim to be. This procedures are a critical function to assess customer risk and a legal requirement to comply with Anti-Money Laundering (AML)

6623b03a320ef

With Pulse's Background Check, companies accelerate the digital onboarding process and reduce the manual work of the back office team, doing fast and secure validation.

SUB TÍTULO HEADER

How it works?

HEADER: IDENTITY DATA VERIFICATION

Pulse has access to multiple data-pools (including government sources) in order to assure the real time validation as long as the coverage of all population. Our solutions can provide up to date information of individuals, background checks and vehicles, in addition to conducting the search for legal proceedings and fore-criminal records of individuals through the more than 250 public and private data sources present in our catalog.

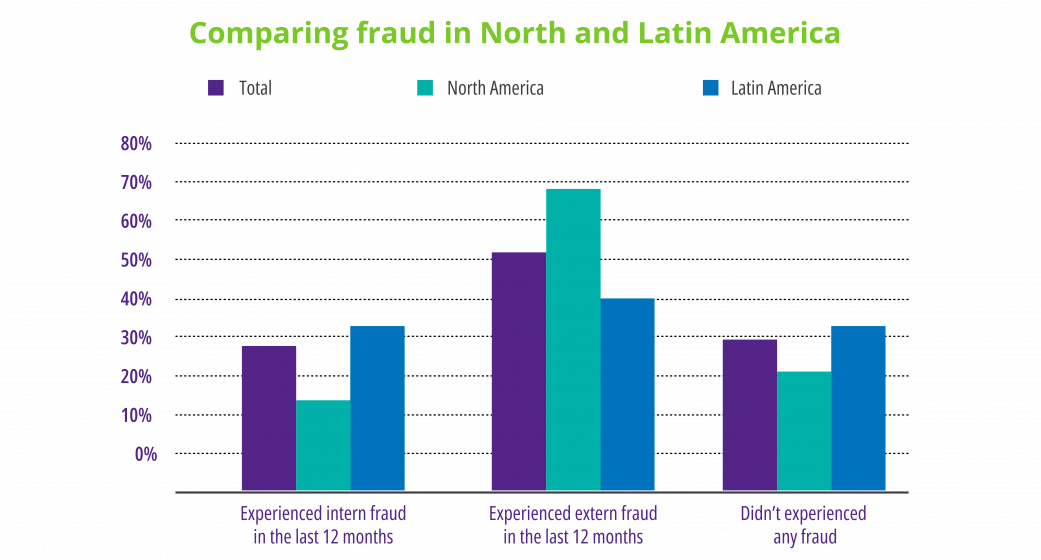

ESTADISTICA

BENEFITS TÍTULO

Benefits

BENEFITS: 4 ITEMS

10+ years of experience managing data for our clients in multiple industries and countries of the Latin American region reinforced our leadership in security solutions.

A fully digital process delivers an excellent user experience and can increase growth in digital channels.

Documents can be verified in miliseconds.

Digital identity verification can assist institutions in meeting Know-You-Customer (KYC) requirements.

Digital identity verification can help institutions reduce fraud when an unknown applicant/potential customer is remote.

TAPS PAISES

OUR IDV PRODUCTS

45% of the identity fraud in Argentina is related to e-commerce. In addition, the use counterfeit cards has increased in 5%.

Our service includes:

![]() FRAUD DETECTION

FRAUD DETECTION

Pulse connects with the following databases to validate that the National Identity Document (Documento Nacional de Identidad / DNI) number present on the ID card exists:

- Argentinian National Registry of Persons (RENAPER).

- Federal Administration of Public Income (AFIP).

- Politically Exposed Person (PEP) This merit also checks if the user associated with the DNI has any sanctions.

![]() ID STATUS

ID STATUS

Consultation that returns the status of an identity document (DNI) issued by RENAPER.

The cost of fraud has risen dramatically for merchants and financial institutions in Brazil. For each fraudulent transaction, the cost to businesses is 3.86 times the value of the lost transaction.

Our service includes:

![]() IDENTITY INFORMATION

IDENTITY INFORMATION

Check the legitimacy of the information and the registration status of a person:

- Receita Federal.

- Political exposed people.

- Microemprendedor Individual (MEI).

- Sistema de Escrituração Digital das Obrigações Fiscais, Previdenciárias e Trabalhistas (eSocial).

- CNIS.

- Email Risk.

- Phone Risk.

![]() LOAN ANALYSIS

LOAN ANALYSIS

Check out the situation of a company or a customer to identify if they have defaulted on paying loans.

![]() TRANSPORTATION

TRANSPORTATION

Check the registration status and license of a driver or vehicle to circulate throughout the Brazilian territory.

![]() LAW AND CRIMINAL RECORDS

LAW AND CRIMINAL RECORDS

Manage risks checking lawsuits, cases and criminal records involving your customers:

- Banco Nacional de Mandados de Prisão (BNMP).

- Polícia Federal: Antecedentes Criminais.

- Polícia Civil: Antecedentes Criminais.

61% of Chilean companies use fraud mitigation best practices only partially.

Our service includes:

![]() RUN VALIDATION

RUN VALIDATION

Verify that a user's RUN number against the Chilean Civil Registry database.

![]() CRIMINAL CERTIFICATE

CRIMINAL CERTIFICATE

If the user has submitted a certicate with a valid sheet number and verication code, the response will include a copy of the certificate.

56% of fraudulent attacks are executed by bots in Colombia, an increase of 14% compared to last year.

Our service includes:

![]() IDENTITY INFORMATION

IDENTITY INFORMATION

Check the legitimacy of the information and the registration status of a person (ID Status).

![]() LAW AND CRIMINAL INFORMATION

LAW AND CRIMINAL INFORMATION

Manage risks checking lawsuits, cases and criminal records involving your customers.

![]() TRANSPORTATION

TRANSPORTATION

Check the registration status and license of a driver or vehicle that circulates throughout the Colombian territory.

![]() CIVIL REGISTRATION

CIVIL REGISTRATION

Check all civil registration in the Colombian territory.

35%of mobile fraud in Mexico is composed of Identity theft by third parties and Account takeover by third parties.

Our service includes:

![]() CURP (Unique Population Registry Code)

CURP (Unique Population Registry Code)

Validate CURP and personal information through RENAPO (National Population Registry).

![]() INE/IFE/PASSPORT

INE/IFE/PASSPORT

Validate the data of a credential in the nominal list of the INE Credential or Passport.

![]() NSS IMSS

NSS IMSS

A solution to obtain the social security number through the CURP of your users and their work history through their NSS.

![]() Auto API

Auto API

A solution that provides general information on the Mexican vehicle fleet using the license plate of each car to be verified.

![]() RFC Check

RFC Check

Provides general information on the Mexican tax id information using the RFC to be verified at SAT.

![]() Full fraud

Full fraud

You will be able to validate three variables in a single API call: email, IP address and phone number. Get a complete X-ray of your users through the connection with their browser, analyze the IP, check suspicious VPNs, TOR users and risky locations in seconds.

Reports of cybercrime, mostly property fraud and computer fraud,are estimated at 300 per month.

Our service includes:

![]() DNI VALIDATION

DNI VALIDATION

Check the legitimacy of the information and the registration status of a person (ID Status).

![]() MIGRATION STATUS

MIGRATION STATUS

Validate that the user's name and birthdate match the information associated with their National Identity Document provided matches the information (Names and Last Names) provided.

![]() HEALTH SOCIAL SECURITY

HEALTH SOCIAL SECURITY

Validate that the information associated with their National Identity Document has an associated entry in Peru's Ministry of Health's Social Security database.

![]() TAX STATUS

TAX STATUS

Validate if the user has an associated entry in Peru's National Customs and Tax Administration Superintendence.

Page Copyright

© Copyright 2022 All Rights Reserved - PULSE LATAM