As digitization advances across the region with the impulse of smartphones and mobile penetration, the market becomes more mature as new industries, whether financial services, e-commerce or payments, expand access to products and services Digital for Latin America. E-commerce is expected to grow 30% each year until 2025, which is why it is considered a hyper-growth market.

The purchase process has been streamlined through the use of digital wallets, which improves the experience and benefits users for their logistical skills and financial innovation.

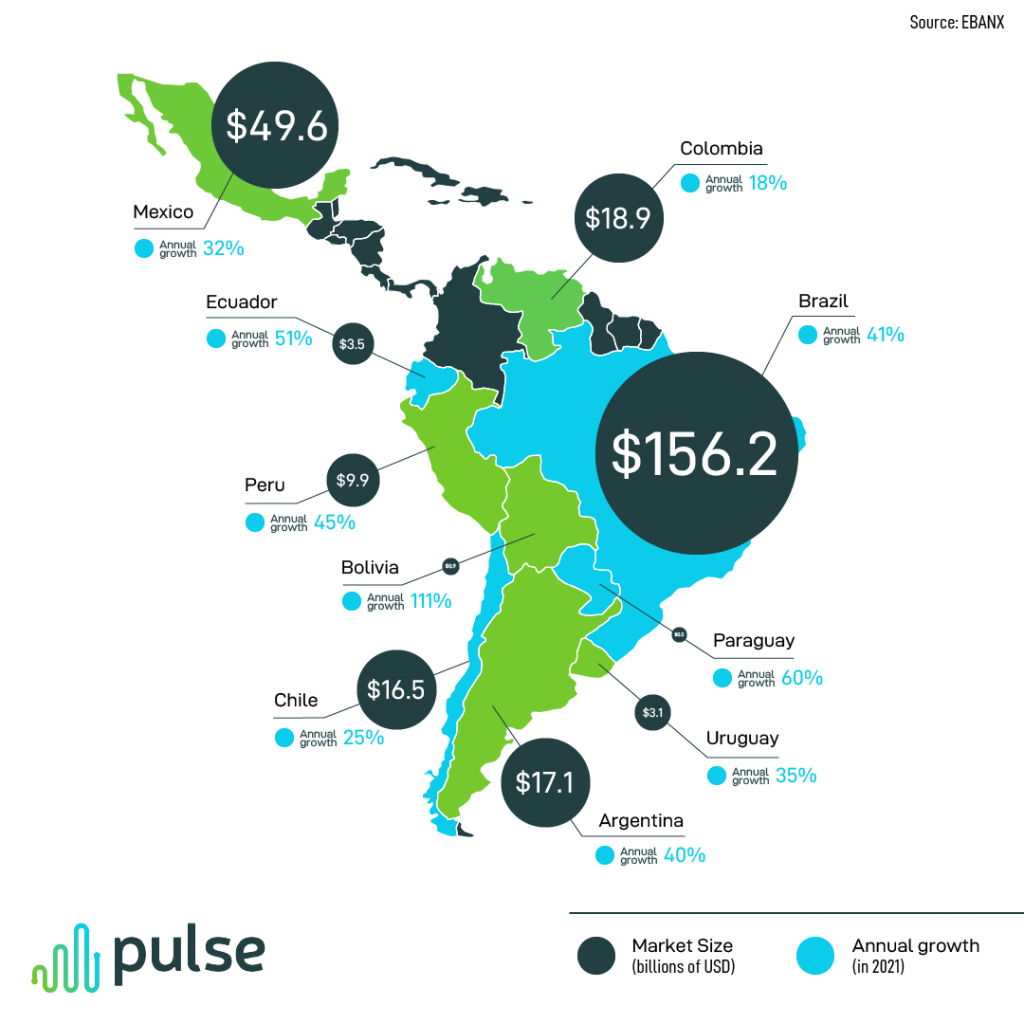

The growth does not only apply to leading markets, such as Brazil, Mexico and Argentina, which despite having almost 70% e-commerce penetration, are expected to grow around 30% annually until 2025. However, it is especially noticeable in smaller countries such as Peru, Bolivia, Paraguay and Guatemala, where growth rates are expected to reach 70% per year.

The opportunities in the region are very marked and we can visualize them in the following graph:

A region facing technological inequalities

Despite technological differences, social and economic inequality, and still emerging internet quality, the Latin market has adopted smartphones as part of their daily lives to carry out all kinds of activities. Technology has enabled people to communicate, access education online during the pandemic, watch movies, and pay their bills. However, in the last two years, after COVID-19 brought millions of new consumers to e-commerce and nurture digitization, smartphones have now also become the preferred way of shopping for consumers in the region.

According to new data from Americas Market Intelligence, based on 15 economies in the region, nearly 60% of total LatAm e-commerce volume was paid through mobile phones in 2021, an increase of 46% compared to 2020.

Optimizing the shopping experience

Although it may seem easier to buy through computers, from mobile devices we can carry out any management in less time and safely. Why?

– We can save our data and autofill the form fields in a couple of clicks.

– With digital wallets, paying is much easier and safer.

– Thanks to fingerprint technology, we can guarantee the security of transactions, such as a confirmation of information to know if the user is really making the purchase.

The latest Beyond Borders study showed that 73% of international digital shoppers in Latin America downloaded a mobile shopping app during the coronavirus pandemic. Having a user-friendly mobile app was cited as the fourth most important factor when Brazilian and Mexican consumers shop online, according to a PwC survey from November 2020.

Achieving expansion in such a diverse region can be complex. However, technology brings us closer and creating effective mobile applications that facilitate the connection with our consumers can mean accelerated growth depending on your relevance in the market and of course their needs. Keep an eye on what your competitors are doing that actually works and find their flaws so you can differentiate from them and take advantage of it.